UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

_____________________________________________________________________

Filed by the registrant x Filed by a party other than the registrant ¨

Check the appropriate box:

|

| | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

AG Mortgage Investment Trust, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of filing fee (Check the appropriate box):

|

| | | | |

| x | No fee required |

| |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

| | | | |

| (1) | Title of each class of securities to which transaction applies: |

| |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| |

| (5) | Total fee paid: |

| |

| |

|

| | | | |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by Registration Statement number, or the Form or Schedule and the date of its filing. |

|

| | | | |

| (1) | Amount previously paid: |

| |

| |

| (2) | Form, Schedule, or Registration Statement No.: |

| |

| |

| (3) | Filing party: |

| |

| |

| (4) | Date filed: |

| |

| |

AG Mortgage Investment Trust, Inc.

245 Park Avenue, 26th Floor

New York, New York 10167

April 29, 2020March 21, 2022

Dear Fellow Stockholders:

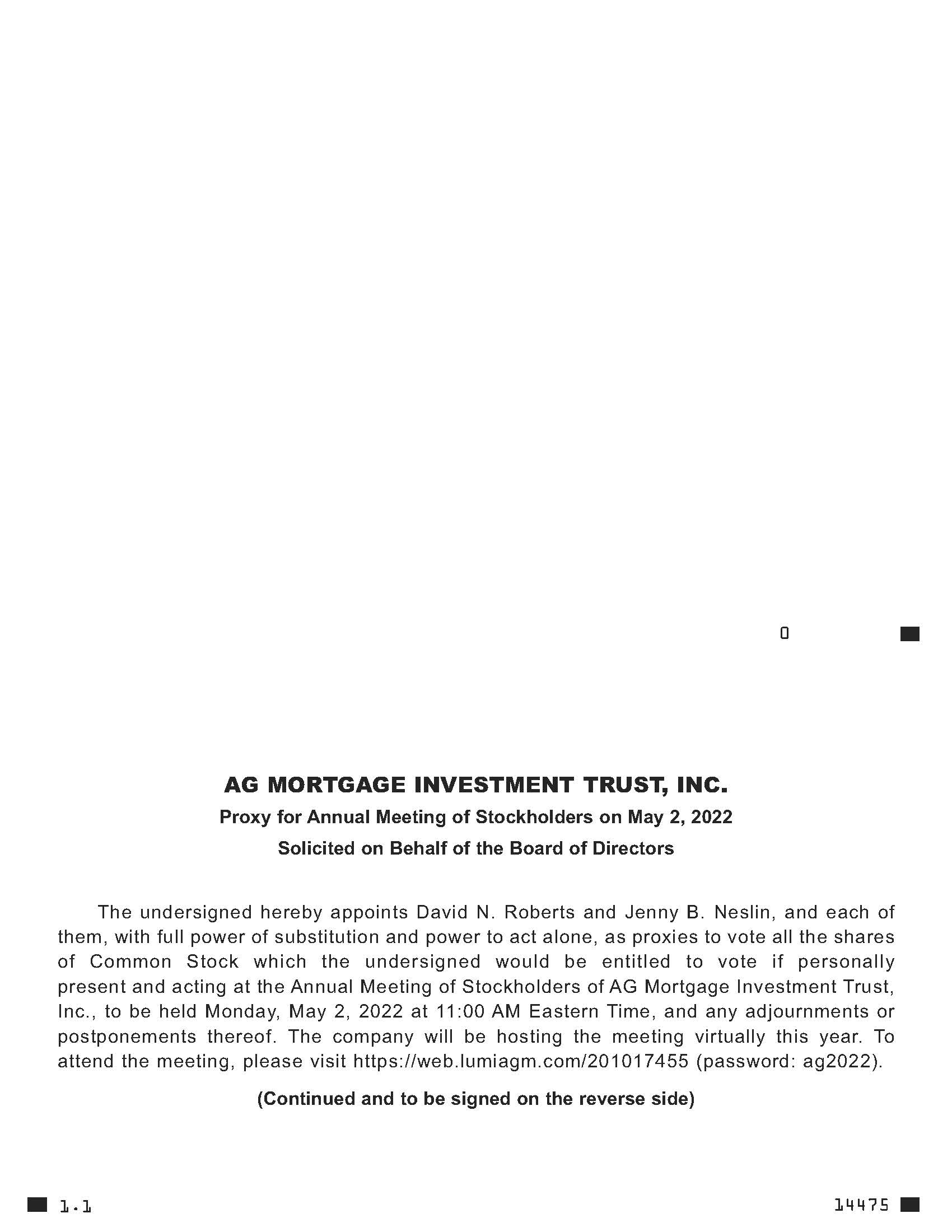

You are cordially invited to attend the 20202022 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”) of AG Mortgage Investment Trust, Inc., which will be held on Friday, June 19, 2020Monday, May 2, 2022 at 3:11:00 p.m.a.m., Eastern Time. Due to the emerging public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders, this year’s Annual Meeting will be held in a virtual meeting format only. We believe that thea virtual meeting format allows the full participation of,by, and interaction with, our stockholder base, while also being sensitive tomindful of the public health and travel concerns that our stockholders may have in light of the COVID-19 pandemic.Youpandemic. You will be able to participate in the Annual Meeting, to vote, and submit your questions via live webcast by visiting www.virtualshareholdermeeting.com/MITT2020.https://web.lumiagm.com/201017455. Details of the business to be presented at the meeting can be found in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.proxy statement (the “Proxy Statement”).

Pursuant to rules adopted by the United States Securities and Exchange Commission, we have provided access to our proxy materials over the Internet. Accordingly, we are sending a notice regarding the Internet availability of proxy materials (“Notice”) on or about April 29, 2020March 21, 2022 to our stockholders of record on May 4, 2020.March 8, 2022. The Notice and Proxy Statement contain instructions for your use ofparticipation in this process, including how to access our proxy statementProxy Statement and annual reportthe Annual Report to Stockholders for the fiscal year ended December 31, 2021 over the Internet, how to authorize your proxy to vote online, and how to request a paper copy of the proxy statementProxy Statement and annual reportAnnual Report to Stockholders if you so desire.

If you are unable to attend the virtual meeting,Annual Meeting, it is nevertheless very important that your shares be represented and voted at the Annual Meeting.voted. You may authorize your proxy to vote your shares over the Internet as described in the Notice and Proxy Statement. Alternatively, if you received a paper copy of the proxy card by mail, please complete, date, sign and promptly return the proxy card by mail so that your shares may be voted. You may also vote by telephone as described in your proxy card. If you vote your shares over the Internet, by mail or by telephone prior to the Annual Meeting, you may nevertheless revoke your proxy and cast your vote electronically via live webcast at the Annual Meeting.

On behalf of the boardBoard of directors,Directors, I extend our appreciation for your participation and continued support.

Sincerely,

David N. Roberts

Chairman of the Board & Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

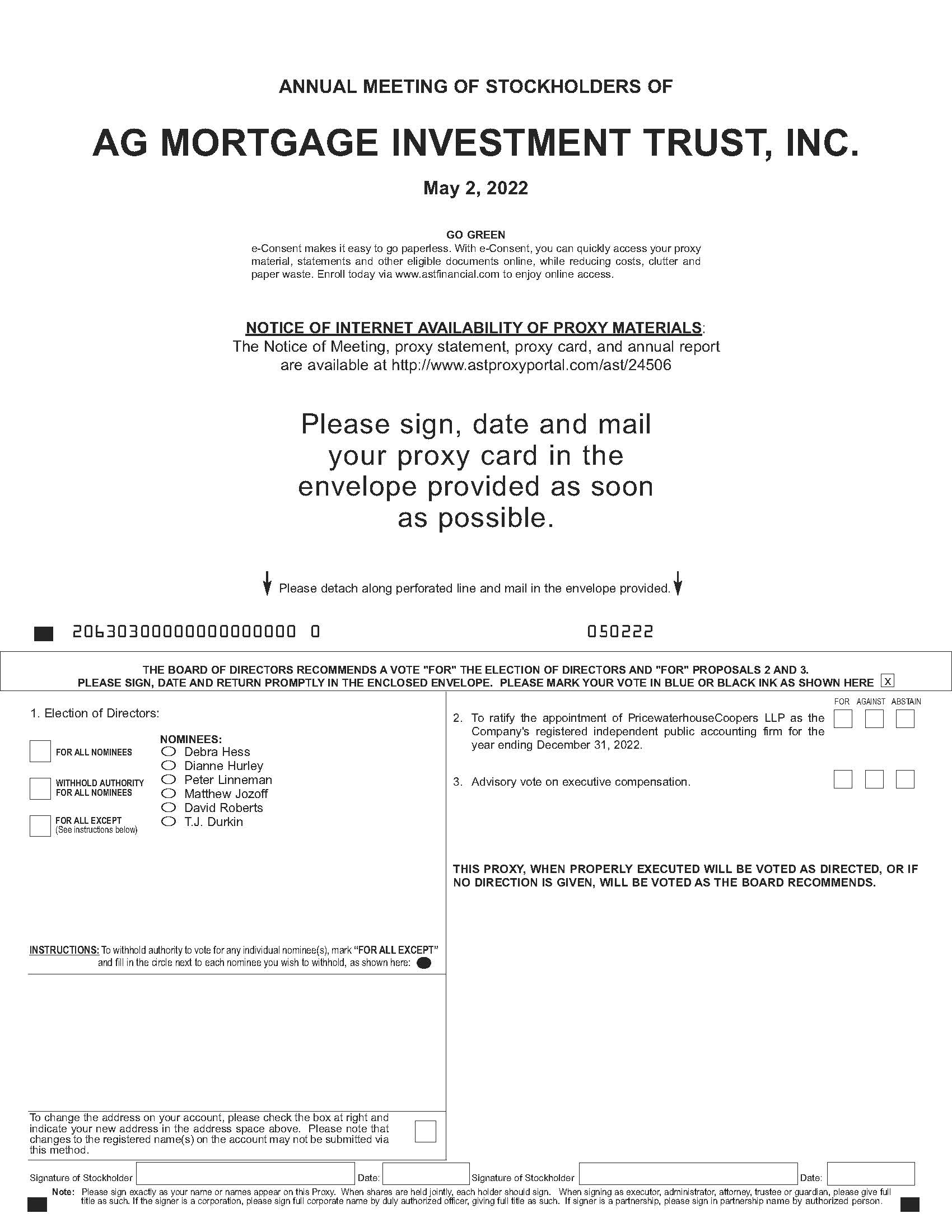

TO BE HELD ON June 19, 2020MAY 2, 2022

NOTICE IS HEREBY GIVEN to holders of shares of common stock of AG Mortgage Investment Trust, Inc., a Maryland corporation (the "Company," "we," "us,"“Company,” “we,” “us,” or "our"“our”), that the 2020Company’s 2022 Annual Meeting Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”) will be held on Friday, June 19, 2020,Monday, May 2, 2022, at 3:11:00 p.m.a.m., Eastern Time. We are very pleased that this year'sIn light of continuing public health concerns, the Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. It is important to note that stockholders will have the same rights and opportunities by participating in a virtual meeting as they would if attendingwebcast like an in-person meeting. You can participate in the Annual Meeting, vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/MITT2020. You must have your 16-Digit Control Number in order to access the Annual Meeting.https://web.lumiagm.com/201017455. The Annual Meeting will be held for the following purposes:

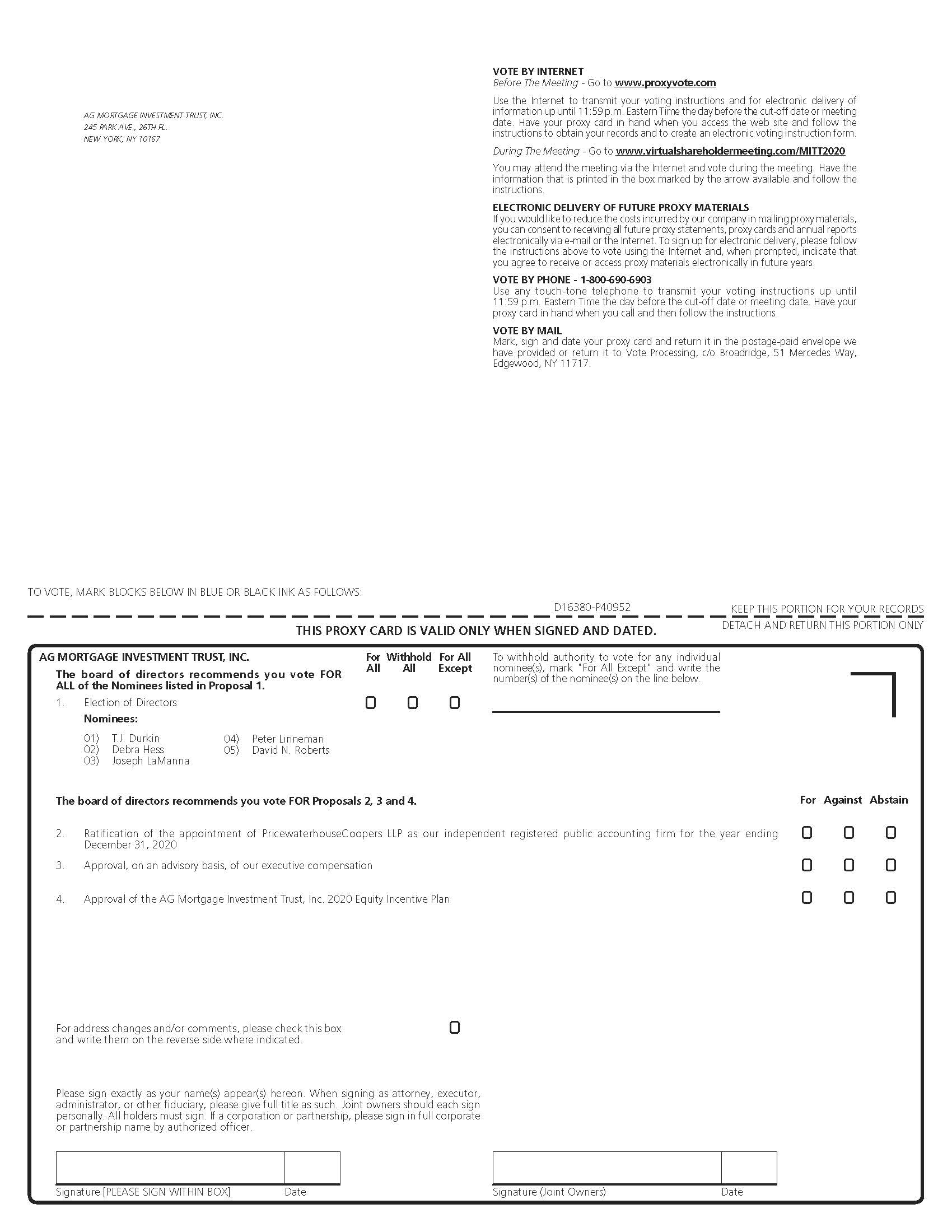

| |

1. | election of the board of directors, with each director serving a one-year term and until his or her successor is elected and qualified; |

| |

2. | ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2020; |

| |

3. | approval, on an advisory basis, of our executive compensation; and |

| |

4. | approval of the AG Mortgage Investment Trust, Inc. 2020 Equity Incentive Plan. |

1.to consider and vote upon the election of six directors, with each director serving until the 2023 annual meeting of stockholders and until his or her successor is duly elected and qualified;

We will transact no

2.to consider and vote upon the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022;

3.to consider and vote upon the approval, on an advisory basis, of our executive compensation, as described in the Proxy Statement; and

4.to consider and vote upon the transaction of such other business at the Annual Meeting, except for businessas may properly broughtcome before the Annual Meeting and any postponement or adjournment or postponement thereof.

We know of no other matter to come before the Annual Meeting. Only holders of record of our common stock at the close of business on May 4, 2020March 8, 2022 (the “Record Date”) are entitled to notice of, and to attend and to vote at, the Annual Meeting and any adjournmentpostponement or postponementadjournment thereof.

If you plan on virtually attending the Annual Meeting, you will need to enter the 16-Digit11-Digit Control Number on your Noticenotice regarding the Internet availability of the Annual Meeting.proxy materials ("Notice"). Whether or not you plan to access the Annual Meeting, please authorize your proxy to vote your shares over the Internet, as described in the Notice. Alternatively, if you received a paper copy of the proxy card by mail, please mark, sign, date and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. Stockholders who authorize a proxy to vote their shares over the Internet, by mail or by telephone prior to the Annual Meeting may nevertheless access the Annual Meeting, revoke their proxies and cast their vote electronically.electronically at the virtual meeting.

By Order of the Board of Directors,

Raul E. MorenoJenny B. Neslin

General Counsel and Secretary

April 29, 2020March 21, 2022

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on Friday, June 19, 2020.Monday, May 2, 2022. This proxy statementProxy Statement and the Company’s Annual Report on Form 10-Kto Stockholders for the fiscal year ended December 31, 20192021 are available on the “Financial Reports” page of the “Investor Relations” section of our web sitewebsite at www.agmit.com.

TABLE OF CONTENTS

AG Mortgage Investment Trust, Inc.

245 Park Avenue, 26th Floor

New York, New York 1016610167

PROXY STATEMENT

FOR

20202022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 19, 2020MAY 2, 2022

This proxy statement (the “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the boardBoard of directorsDirectors (the “Board”) of AG Mortgage Investment Trust, Inc. (the “Company,” “we,” “us” or “our”) for use at our 20202022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Friday, June 19, 2020Monday, May 2, 2022 at 3:11:00 p.m.a.m., Eastern Time. Due to the emerging public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders,this year'syear’s Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. We believe that the virtual meeting format allows the full participation of,by, and interaction with, our stockholder base, while also being sensitive tomindful of the public health and travel concerns that our stockholders may have in light of the COVID-19 pandemic.

It is important Any reference herein to note that stockholders will have the same rights and opportunities by participating in a virtual meeting as they would if attending an in-person meeting. You can participate in the Annual Meeting, including any reference to “in-person” attendance, means attending by remote communication via live webcast on the Internet.

Like an in-person meeting, you can vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/MITT2020.https://web.lumiagm.com/201017455. You must have your 16-Digit11-Digit Control Number in order to access the Annual Meeting. The proxy statement,Proxy Statement, proxy card, and our 2019 annual report2021 Annual Report to stockholdersStockholders (the “Annual Report”) will be distributed or made available on or about March 21, 2022 to stockholders of record on or about April 29, 2020.the Record Date.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

|

| | | | | | | |

| In this section of the proxy statement,Proxy Statement, we answer some common questions regarding our 2020 annual meetingAnnual Meeting and the voting of shares at the meeting. |

|

| Q: | Where and when will the annual meeting be held? |

| | | |

| A: | The meeting will be held held on Friday, June 19, 2020Monday, May 2, 2022 at 3:11:00 p.m.a.m., Eastern Time. You will be able to participate in the Annual Meeting, vote and submit your questions via live webcast by visiting www.virtualshareholdermeeting.com/MITT2020https://web.lumiagm.com/201017455. To satisfy the requirements for admission to the Annual Meeting, please use the passcode "ag2022". |

|

| | | | | | | |

| Q: | Why is the Company holding a virtual meeting? |

| | |

| A: | We feel it is appropriate this year to hold a virtual Annual Meeting due to the continuing public health impact of the coronavirus outbreak (COVID-19)COVID-19 and to support the health and well-being of our directors, executive officers and stockholders and their friends and family. We value and encourage broad investor participation and believe that a virtual meeting provides an opportunity for stockholders to attend and participate from their homes while minimizing public safety risks. A virtual meeting, while affording stockholders the same rights and opportunities to participate as they would at an in-person meeting, is also cost-effective for both the Company and its investors, saving travel, venue rental, catering and other expenses. |

|

| | | | | | | |

| Q: | What is the quorum for the meeting? |

| | |

| A: | A quorum will be present at the Annual Meeting if a majority of the votes entitled to be cast are present, whether in person or by proxy. No business may be conducted at the Annual Meeting if a quorum is not present. As of April 25, 2020, 32,823,511the Record Date, 23,915,293 shares of common stock were issued and outstanding.outstanding, and each share of common stock is entitled to one vote. If less than a majority of outstanding shares entitled to vote are represented at the Annual Meeting, we expect that the Annual Meeting will be adjourned in order to solicit additional proxies.proxies creating the necessary quorum. Notice need not be given of the new date, time or place if announced at the Annual Meeting before an adjournment is taken.taken and the new date of the Annual Meeting is not more than 120 days from March 8, 2022, the record date for the Annual Meeting. Shares that are voted “For,” “Against,” “Abstain,” or, with respect to the election of directors, “Withhold,” will be treated as being present at the Annual Meeting for purposes of establishing a quorum. Accordingly, if you are a stockholder of record as of the Record Date and have returned a valid proxy or attend the Annual Meeting, your shares will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting. Broker non-votes will also be counted as present for purposes of determining the presence of a quorum. |

|

| | | | | | | |

| Q: | What am I voting on? |

| | |

| A: | (1) | ElectionThe election of fivesix directors for termseach serving until the 2023 annual meeting of one year;stockholders and until his or her successor is duly elected and qualified; |

| | |

| (2) | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020;the year ending December 31, 2022; and |

| | |

| (3) | Approval, on an advisory basis, of our executive compensation; and |

| | |

| (4) | Approval of the AG Mortgage Investment Trust, Inc. 2020 Equity Incentive Plan. |

| | compensation, as described in this Proxy Statement. |

|

| | | | | | | |

| Q: | How does the board of directorsBoard recommend that I vote on these proposals? |

| | |

| A: | (1) | “FOR” the election of each of the nominees as directors; |

| | |

| (2) | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020;2022; and |

| | |

| (3) | “FOR” the approval, on an advisory basis, of the advisoryour resolution on executive compensation; andcompensation, as described in the Proxy Statement. |

| | |

| (4) | "FOR" the approval of the AG Mortgage Investment Trust, Inc. 2020 Equity Incentive Plan. |

| | |

|

| | | | | | | |

| Q: | Who is entitled to vote? |

| | |

| A: | Only common stockholders of record of our common stock as of the close of business on May 4, 2020 (the “Record Date”)the Record Date or their duly authorized proxies are entitled to vote at the Annual Meeting. |

|

| | | | | | | |

| Q: | How do I vote? |

| | |

| A: | Whether or not you plan to accessattend the Annual Meeting, we urge you to authorize your proxy to vote your shares over the Internet as described in your notice regarding the Notice.Internet availability of proxy materials (“Notice”). Alternatively, if you received a paper copy of the proxy card by mail, please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. Authorizing your proxy over the Internet, by mailing a proxy card or by telephone will not limit your right to attend the Annual Meeting and vote your shares in person. |

|

| | | | | | | |

| Q: | How do I vote my shares that are held by my broker? |

| | |

| A: | If you have shares held by a broker, you may instruct your broker to vote your shares by following the instructions that the broker provides to you. Most brokers allow you to authorize your proxy by mail, telephone and on the Internet. |

|

| | | | | | | |

| Q: | How do I vote my shares at the Annual Meeting? |

| | |

| A: | First, you must satisfy the requirements for admission to the Annual Meeting by visiting https://web.lumiagm.com/201017455 and entering the 16-Digit Control Number on your Notice of the Annual Meeting.passcode "ag2022". Then, if you are a stockholder of record as ofat the close of business on May 4, 2020,March 8, 2022, you may cast your vote electronically via live webcast at the Annual Meeting.

You may vote shares held in “street name” at the Annual Meeting only if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Even if you plan to accessattend the Annual Meeting, we encourage you to authorize a proxy to vote your shares in advance by Internet, telephone or mail so that your vote will be counted even ifin the event you later decide not to attend the Annual Meeting. |

|

| | | | | | | |

| Q: | How many votes do I have? |

| | |

| A: | You are entitled to one vote for each whole share of common stock you hold as of the Record Date. Our stockholders do not have the right to cumulate their votes for directors. |

|

| | | | | | | |

| Q: | What are the voting requirements that apply to the proposals discussed in this Proxy Statement? |

| | |

| A: | With respect to the election of directors, you may vote “For” all nominees, “Withhold” your vote as to all nominees, or you may vote “For All Except” one or more nominees. A properly executed proxy statement?marked “Withhold” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Members of the Board are elected by a plurality of votes cast, in person or by proxy, at the Annual Meeting, provided that a quorum is present. This means the six nominees who receive the greatest number of “For” votes cast will be elected. Neither broker non-votes nor votes marked “Withhold” will have an effect with respect to the election of any nominee.

You may vote “For,” “Against” or “Abstain” on Proposals 2 and 3. To be approved, each of Proposals 2 and 3 must receive the affirmative vote of a majority of the votes cast, in person or by proxy, at the Annual Meeting on the proposal, provided that a quorum is present. Abstentions and broker non-votes, if any, will not be counted as votes cast on Proposals 2 and 3 and will have no effect on the result of the vote. |

|

| | | | | | | | | | | | | |

A: | | Proposal | | Vote Required | | Discretionary Voting Allowed? |

| (1) | Election of directors | | Plurality** | | No |

| (2) | Ratification of the appointment of PricewaterhouseCoopers LLP | | Majority* | | Yes |

| (3) | Advisory voteApproval, on an advisory basis, of our executive compensation | | Majority* | | No |

| (4) | Approval | | |

| * “Majority” means a majority of the 2020 Equity Incentive Planvotes cast at the Annual Meeting on the particular matter. |

| | Majority* | | No |

* “Majority” means a majority of the votes cast at the Annual Meeting.

** “Plurality” means with regard to the election of directors, that the five** “Plurality” means with regard to the election of directors, that the six nominees for director receiving the greatest number of “for” votes from our shares entitled to vote will be elected.

|

| | | | | | | |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| | |

| A: | If your shares are registered in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are the “stockholder of record” of those shares. |

| | |

| If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of those shares. The Notice Regarding the Availability ofand Proxy Materials (the “Notice”) and proxy statementStatement and any accompanying documentsdocument have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet. |

|

| | | | | | | |

| Q: | How do I aceessattend the Annual Meeting? |

| | |

| A: | You can participate inattend the Annual Meeting, vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/MITT2020.https://web.lumiagm.com/201017455. You must have your 16-Digit Control Number found on your Notice ofuse the Annual Meeting passcode "ag2022"in order to access the Annual Meeting. Online access to the webcast will open 60 minutes prior to the start of the Annual Meeting to allow time for you to log-in and test your device. We encourage you to access the webcast in advance of the designated start time. |

|

| | | | | | | |

| Q: | May stockholders ask questions at the Annual Meeting? |

| | |

| A: | Yes. There will be time allotted at the end of the meeting when our representatives will answer questions from participants of the webcast. |

|

| | | | | | | |

| Q: | Why did I not receive my proxy materials in the mail? |

| | |

| A: | As permitted by rules of the United States Securities and Exchange Commission (the “SEC”), we are making this proxy statementProxy Statement and our 2019 annual report,the Annual Report, which includes our annual reportAnnual Report on Form 10-K for the fiscal year ended December 31, 2019 (“Annual Report”),2021, available to our stockholders electronically via the Internet. The “e-proxy” process expedites stockholders’ receipt of proxy materials and lowers the costs and reduces the environmental impact of our Annual Meeting. |

| | |

| On or about April 29, 2020,March 21, 2022, we mailed to stockholders of record, as of the close of business on the Record Date, the Notice containing instructions on how to access this proxy statement,Proxy Statement, our Annual Report and other soliciting materials via the Internet. If you received the Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you had previously indicated that you wanted to receive a printed copy. The Notice instructs you on how to access the proxy statementProxy Statement and Annual Report and how you may submit your proxy. |

|

| | | | | | | |

| Q: | Can I vote my shares by filling out and returning the Notice? |

| | |

| A: | No. The Notice identifies the items to be voted on at the annual meeting,Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to authorize your proxy via the Internet or by telephone or vote in person at the annual meetingAnnual Meeting or to request a paper proxy card, which will contain instructions for authorizing a proxy by the Internet, by telephone or by returning a signed paper proxy card. |

|

| | | | | | | |

| Q: | Will there be any other items of business on the agenda? |

| | |

| A: | The board of directors doesWe do not know of any other mattersmatter that may be brought before the Annual Meeting nor does itdo we foresee or have reason to believe that proxy holders will have to vote for substitute or alternate nominees for election to the board of directors.Board. In the event that any other matter should come before the Annual Meeting or any nominee is not available for election, the persons named in the enclosed proxy will have discretionary authority to voteexercise all proxies with respect to such matters in accordance with their discretion. |

|

| | |

Q: | Will anyone contact me regarding this vote? |

| | |

A: | No arrangements or contracts have been made with any solicitors as of the date of this proxy statement, although we reserve the right to engage solicitors if we deem them necessary. Such solicitations may be made by mail, telephone, facsimile, e-mail or in person. |

|

| | |

| Q: | Who has paid for this proxy solicitation? |

| | |

| A: | We pay for the cost of preparing, printing and mailing the Notice and, to the extent requested by our stockholders, the proxy materials and any additional materials furnished to stockholders. Proxies may be solicited by our directors or our executive officers or by executive officers of AG REIT Management, LLC (our “Manager”) personally, by e-mail or by telephone without additional compensation for such activities. We have also retained D.F. King & Co., Inc. to perform proxy solicitation services at a fee estimated at $7,000, plus out of pocket expenses. We will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send appropriate solicitation materials to such beneficial owners, and we will pay such holders their standard and ordinary fees. We will also reimburse such holders for their reasonable out-of-pocket expenses. |

|

| | | | | | | |

| Q: | What does it mean if I receive more than one Notice? |

| | |

| A: | It probably meansIf you receive more than one Notice, your shares are registered differently andin more than one name or are registered in more than one account. Sign and return all proxy cards to ensure that all your shares are voted. |

|

| | | | | | | |

| Q: | What if I return a signed proxy or voting instruction card, but do not specify how my shares are to be voted? |

| | |

| A: | If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, all of your shares will be voted FOR Proposals 1, 2, 3, and 4.3. |

| | |

| If you are a beneficial owner and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the New York Stock Exchange (“NYSE”), brokers and other nominees have the discretion to vote on routine matters, such as Proposal 2, but do not have discretion to vote on non-routine matters, such as Proposals 1 3, and 4.3. Therefore, if you do not provide voting instructions to your broker or other nominee, your broker or other nominee may only vote your shares on Proposal 2 and any other routine matters properly presented for a vote at the Annual Meeting. |

|

| | | | | | | |

| Q: | How are abstentions and "broker non-votes" treated? |

| | |

| A: | Under NYSE rules, brokers or other nominees who hold shares for a beneficial owner have the discretion to vote on a limited number of “routine” proposals when they have not received voting instructions from the beneficial owner at least ten days prior to the Annual Meeting. Your shares may be voted on Proposal 2 if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions, since the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firms is considered a "routine"“routine” proposal. All other items on this year'syear’s ballot are considered "non- routine"“non-routine” proposals under NYSE rules for which brokers may not vote absent voting instructions from the beneficial owner. A “broker non-vote” occurs when a broker or other nominee does not vote on a particular proposal because such broker or nominee does not receive such voting instructions and does not have the discretion to vote the shares. Pursuant to Maryland law, abstentions and broker non-votes are not included in the determination of the shares of common stock voting on such matters, but are counted for quorum purposes. |

|

| | | | | | | |

| Q: | Can I change my vote after I have voted? |

| | |

| A: | Yes. You can change your vote either by:

ž •executing or authorizing, dating and delivering to us a new proxy with a later date that is received no later than June 18, 2020;April 29, 2022;

ž •voting again via the Internet or by telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Daylight Time, on June 18, 2020;April 29, 2022;

ž •sending a written statement revoking your proxy card to our General Counsel or any corporate officer of the Company, provided such statement is received no later than June 18, 2020;April 29, 2022; or

ž •by accessingattending the Annual Meeting, revoking your proxy and voting electronically via live webcast at the Annual Meeting.

Your virtual attendance at the Annual Meeting will not, by itself, revoke a proxy previously authorized by you. We will honor the proxy card or authorization with the latest date.

Proxy revocation notices should be sent to AG Mortgage Investment Trust, Inc., 245 Park Avenue, 26th Floor, New York, New York 10167, Attention: General Counsel. New paper proxy cards should be sent to Vote Processing,Proxy Tabulation Department, c/o Broadridge, 51 Mercedes Way, Edgewood,American Stock Transfer and Trust Company, LLC, 6201 15th Avenue, Brooklyn, NY 11717.11219. |

|

| | | | | | | |

| Q: | Can I find additional information on the Company’s web site?website? |

| | |

| A: | Yes. Our web site (the “Company’s Web Site”)website is located at www.agmit.com. Although the information contained on the Company’s Web Siteour website is not part of this proxy statement,Proxy Statement, you can view additional information on the Company’s Web Site,our website, such as our corporate governance guidelines, our code of business conduct and ethics, charters of our board committees and reports that we file with the SEC. |

PROPOSAL 1: ELECTION OF DIRECTORS

Our nominatingBoard currently consists of six members, including four directors that meet the independence standards of the NYSE. Our Nominating and corporate governance committeeCorporate Governance Committee analyzes the composition of our board of directorsBoard each year. In connection with this review, the nominatingBoard, upon the recommendation of the Nominating and corporate governance committee concluded that the individuals set forth inCorporate Governance Committee, nominated the following paragraph should be nominatedsix individuals to serve until the 20212023 annual meeting of stockholders and until their successors are duly elected and qualified. Accordingly, our board of directors agreed with all of these conclusions. Our board of directors currently consists of seven persons, including four directors that meet the independent standards of the New York Stock Exchange. On October 29, 2019, Arthur Ainsberg advised the Board that he did not intend to stand for re-election, and thus his term will expire at the Annual Meeting. In order to assist the Company in complying with New York Stock Exchange listing requirements relating to director independence, Mr. Sigman notified the Company that he would not stand for re-election as a director at the Annual Meeting. He will continue to serve as the Company’s Chief Financial Officer.

At the Annual Meeting, directors will be elected to serve until the 2021 annual meeting and until their successors are duly elected and qualified. Our board of directors has nominated the following individuals, each of which currently serves on the Board,qualified: David N. Roberts, T.J. Durkin, Debra Hess, Joseph LaMannaDianne Hurley, Matthew Jozoff and Peter Linneman (each a “Nominee,” and, collectively, the “Nominees”), to.

All of the Nominees currently serve as directors untilon the Board and were elected by the stockholders at the 2021 annual meeting and until their successors are duly elected and qualified.of stockholders, except for Mr. Jozoff, who was nominated by the Board for election at the Annual Meeting. The board of directorsBoard anticipates that, if elected, each Nominee will serve as a director. However, if any Nominee is unable to accept election, the proxies will be voted for the election of such other person or persons as the boardBoard may recommend, unless the Board determines to reduce the number of directors may recommend.or to leave a vacant seat on our Board in accordance with the Company’s charter and bylaws.

RECOMMENDATION OF THE BOARD:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS.

The voting requirements for this proposal are described above and in the “General Information About the Annual Meeting and Voting” section.section of this Proxy Statement.

DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

Information Regarding Director Nominees

We believe that all of the Nominees are intelligent, collegial, insightful, proactive with respect to management and risk oversight, diligent and exercise good judgment. The biographical descriptions below set forth certain information with respect to each Nominee for election as a director at the Annual Meeting, including the age of each Nominee as of the date of this proxy statement,Proxy Statement, and the experience, qualifications, attributes or skills of each Nominee that led us to conclude that such person should serve as a director.

|

| | | | | | | |

David N. Roberts Chairman of the Board & Chief Executive Officer and President Age: 5860 | | Mr. Roberts joined Angelo, Gordon & Co., L.P. ("Angelo Gordon") in 1993 and is Head of Strategy. He is a Managing Director and a member of the firm’s Advisory Board and Executive Committee. At Angelo Gordon, Mr. Roberts has been responsible for helping start and grow a number of the firm’s businesses, including opportunistic real estate, private equity, net lease real estate, residential mortgage-backed securities and energy lending. Within private equity, Mr. Roberts focused in particular on investments in the specialty finance area, including helping create and serving for over 15 years as Lead Director of publicly traded PRA Group, Inc. (formerly Portfolio Recovery Associates, Inc.), a former Angelo Gordon portfolio company whose primary business is the purchase, collection, and management of portfolios of nonperforming loans. Prior to Angelo Gordon, from 1989 to 1993, Mr. Roberts was a Principal at Gordon Investment Corporation, a Canadian merchant bank, where he participated in a wide variety of principal transactions. He also worked in the Corporate Finance Department at L.F. Rothschild where he specialized in mergers and acquisitions. Mr. Roberts has a B.S. degree from The Wharton School of the University of Pennsylvania. He serves as our Chairman and Chief Executive Officer and President and has served as a director of the Company since 2011. Prior to April 2021, Mr. Roberts also served as our President, a position he had held since 2011. Due to his senior management and finance experience and his experience as a director of public and private boards, we believe Mr. Roberts should serve as a member of our board of directors.Board. |

| | | |

T.J. Durkin Chief Investment

OfficerPresident

Age: 3739 | | Mr. Durkin joined Angelo Gordon in 2008 and is a Managing Director, a member of the firm’s Advisory Board, Executive Committee and Co-Head of the firm’s Structured Credit Platform. T.J. hasMr. Durkin serves as our President and served as our Chief Investment Officer sincefrom October 31, 2017 andthrough April 2021. Mr. Durkin also serves as co-Portfolio Manager of Angelo Gordon’s residential mortgage and consumer debt securities portfolios and as a board member of Arc Home, Angelo Gordon’s affiliated mortgage originator and GSE licensed servicer. Prior to joining Angelo Gordon, T.J.Mr. Durkin began his career at Bear, Stearns & Co. where he was a Managing Director on the Non-Agency Trading Desk focused on the structuring and trading of multiple asset classes, including subprime, Alt-A, second lien and small balance commercial. T.J.Mr. Durkin earned his Bachelor’s degree in finance from the Fordham University and currently serves as a member of the school’s President's Council. He is also a board member of VE International, a not-for-profit organization focused on preparing high school students for college and careers through skills learned in an entrepreneurship based curriculum. He has served as an executive officer of the Company since 2017 and as a director since 2018. Due to his vast industry experience and mortgage and structured products expertise, we believe Mr. Durkin should serve as a member of our board of directors.Board. |

| | |

| | | |

|

| | | | | | | |

Debra Hess Lead Independent Director (effective May 2, 2022)

Age: 5657

Committees:Committees (prior to May 2, 2022):

- Audit (Chair) - Compensation

Committees (effective May 2, 2022): - Audit - Compensation - Nominating and Corporate Governance

(Chair) | | Ms. Hess most recently served as Chief Financial Officer of NorthStar Asset Management Group’s Chief Financial Officer, a position she heldGroup Inc. (NYSE: NSAM) from July 20112014 until January 2017, when NorthStar merged with Colony Capital. Ms. Hess had also served as Chief Financial Officer of NorthStar Realty Finance Corp. since(NYSE: NRF) from July 2011. Until2011 to January 2017, when NRF merged with Colony Capital. During her tenure at NorthStar until August 2015, Ms. Hess served as Chief Financial Officer for NorthStar'sof NorthStar’s non-traded companies. Ms. Hess also served as Interim Chief Financial Officer of NorthStar Realty Europe Corp. (NYSE: NRE) from June 2015 to November 2015. Prior to joining NorthStar, Ms. Hess previously served as Chief Financial Officer of H/2 Capital Partners, where she was employed from August 2008 to June 2011. From March 2003 to July 2008, Ms. Hess was a managing director at Fortress Investment Group, where she also served as Chief Financial Officer of Newcastle Investment Corp., a Fortress portfolio company and a NYSE-listed alternative investment manager. From 1993 to 2003, Ms. Hess served in various positions at Goldman, Sachs & Co., including as Vice President in Goldman Sachs’ Principal Finance Group and as a Manager of Financial Reporting in Goldman Sachs’ Finance Division. Prior to 1993, Ms. Hess was employed by the Chemical Banking Corporation in the corporate credit policy group and by Arthur Andersen & Company as a supervisory senior auditor. Ms. Hess currently serves on the Boardboard of Directorsdirectors, including as Chair of its audit committee, of Radian Group Inc. (NYSE: RDN) and serves on the Audit Committee and Finance Committee, and on the Boardboard of Directorsdirectors of CenterPoint Properties Trust where she is the chair of the Audit Committee.audit committee. Ms. Hess holds a Bachelor of Science in Accounting from the University of Connecticut and a Master of Business Administration in Finance from New York University. Ms. Hess has served as a director of the Company since February 2018. Due to her extensive mortgage banking, finance and real estate experience, her role as the Chief Financial Officer of various publicly traded companies in our sector, and her significant financial, accounting and compliance experience at public companies, we believe Ms. Hess should serve as a member of our board of directors.Board. |

| | |

| | |

Joseph LaMannaDianne Hurley

Lead Independent Director

Age: 6059

Committees:

- CompensationCommittees (prior to May 2, 2022):

- Audit - Nominating and Corporate Governance

Committees (effective May 2, 2022): - Audit (Chair) - Nominating and Corporate Governance | | Mr. LaManna worked at William Blair & Company, LLC from 1987 until his retirement in 2005. During his tenure at William Blair, Mr. LaManna served in several different roles, including senior specialty finance analyst, headMs. Hurley is currently the Chief Financial and Operations Officer of Moravian Academy. Previously, she was the Chief Administrative Officer of A&E Real Estate, one of the business services group,largest owner/operators of multi-family real estate in New York City. Since 2015, Ms. Hurley has also worked as an operational consultant to various startup asset management firms, including BayPine Capital, Stonecourt Capital and Imperial Companies. From September 2009 to November 2011, Ms. Hurley served as the first Chief Operating Officer of Global Distribution in the Asset Management Division of Credit Suisse. From 2004 to September 2009, Ms. Hurley served as the founding Chief Administrative Officer of TPG-Axon, a large investment management firm affiliated with TPG Capital. Ms. Hurley began her career in the real estate department of Goldman, Sachs & Co. Ms. Hurley currently serves as the Chair of the Audit Committee for American Healthcare REIT, Inc. (fka, Griffin-American Healthcare REIT IV). She has also previously served as an independent director of research. In addition, he was a member ofan additional three public companies within the firm’s executive committee, equity capital markets committee and audit committee for four years. Mr. LaManna has served on the boards of directors of several privately-held companies in the financial servicesreal estate industry. He is a Chartered Financial Analyst, and heMs. Hurley holds a B.A. degree in economicsBachelor of Arts from Harvard University and business administrationa Master of Business Administration from Knox College and an M.B.A. degree in finance from the UniversityYale School of Chicago. HeManagement. Ms. Hurley has served as a director of the Company since 2011.December 2020.

Due to hisher extensive financial and investmentreal estate experience, as well as hisher experience as a director for several other financial servicespublic companies, we believe Mr. LaMannaMs. Hurley should serve as a member of our board of directors.Board. |

| | |

| | | | | | | | |

Matthew Jozoff

Independent Director Nominee

Age: 56

Committees (effective May 2, 2022): - Audit - Compensation | | Mr. Jozoff is currently a Managing Director at Radkl, a quantitative trading firm for digital assets and cryptocurrencies, where he has served since 2021. Prior to joining Radkl, Mr. Jozoff served in various positions at J.P. Morgan Chase & Co., including as a Managing Director and Co-Head of Fixed Income, Currencies, Commodities and Index Research (2019-2021); Head of Rates and Securitized Products Research (2013-2019); and Head of Mortgage/Securitized Products Research (2006-2013). Prior to joining J.P. Morgan, Mr. Jozoff worked at Goldman Sachs & Co. as a Vice President and Head of Mortgage Strategy from 1997 to 2006 and at Lehman Brothers in its Mortgage Research division from 1991 to 1997. Mr. Jozoff holds a Bachelor of Arts from Princeton University and a Master of Business Administration from the University of Pennsylvania.

Due to his extensive experience in the mortgage origination, fixed income and finance industries, we believe Mr. Jozoff should serve as a member of our Board. |

| | |

Peter Linneman Independent Director Age: 6970 Committees: - Compensation (Chair) - Nominating and Corporate Governance

| | Dr. Linneman is currently the Emeritus Albert Sussman Professor of Real Estate, Finance, and Public Policy at the University of Pennsylvania, Wharton School of Business where he has been on the faculty since 1979. At Wharton, he was the Director of the Samuel Zell and Robert Lurie Real Estate Center from 1986-1998 and the Chairperson of the Wharton Real Estate Department from 1994-1997. He holds both a masters and a doctorate degree in economics from the University of Chicago. Dr. Linneman is also the founding principal of Linneman Associates, a real estate advisory firm, and the CEO of American Land Funds and KL Realty Fund, both private real estate acquisition firms. He currently serves on the board of directors of Regency Centers Corporation (NYSE: REG), Paramount Group, Inc. (NYSE: PGRE) and Equity Commonwealth (NYSE: EQC), each of which is a public real estate investment trust. Dr. Linneman has served on over 20 public and private company boards, including as director of eleven New York Stock Exchange listed companies. Dr. Linneman holds both a masters and a doctorate degree in economics from the University of Chicago. He has served as a director of the Company since 2011.

Due to his extensive academic and business experience in real estate, his understanding of complex financial structures and his experience as a member of several public and private boards, including many real estate investment companies, we believe Dr. Linneman should serve as a member of our board of directors.

Board. |

Biographical Information Regarding Executive Officers Who Are Not Directors

The following is a list of individuals serving as executive officers of the Company.Company, other than David N. Roberts (our Chairman and Chief Executive Officer) and T.J. Durkin (our President), who serve as members of our Board in addition to their roles as executive officers. For Messrs. Roberts’ and Durkin’s biographical information, see “Information Regarding Director Nominees” above. All of our executive officers serve at the discretion of the board of directors or the chief executive officer.

Board.

| | | | | | | | |

Nicholas Smith

Chief Investment Officer

Age: 41 | | Mr. Smith joined Angelo Gordon’s structured credit team as a Managing Director in April 2021 and was appointed as our Chief Investment Officer, effective April 2021. Prior to joining Angelo Gordon, Mr. Smith was the Head of Non-Agency Residential Mortgage Trading and Asset-Backed Securities Trading at Bank of America Securities. At Bank of America Securities, he led a team of over 30 professionals and built and oversaw the organization’s Whole Loan Purchase Program. Previously, he served as Director on Guggenheim Securities’ Residential Mortgage Trading and Banking team and Bear Stearns’ Residential Mortgage Finance and Trading team. Mr. Smith graduated from Colgate University with a degree in Mathematical Economics. |

| | |

Brian C. SigmanAnthony Rossiello

Chief Financial Officer and Treasurer Age: 4234 | | Mr. SigmanRossiello joined Angelo GordonGordon’s finance team in 20132020 and is the firm’s Chief Financial Officer. He also currently serveswas appointed as Chief Financial Officer of the firm’s Structured Credit Platform and has been our Chief Financial Officer and Treasurer since September 4, 2013.and a Managing Director of Angelo Gordon, effective January 2021. In this position, Mr. SigmanRossiello also serves as our Principal Financial and Accounting Officer. Mr. Rossiello has previously served as our Controller and interim Principal Accounting Officer from 2013 through 2019.during 2020. Prior to joining Angelo Gordon, Mr. Sigman was the Chief Financial Officer, Principal Accounting Officer and Treasurer of Newcastle Investment Corp. (“Newcastle”) from August 2008 to May 2013. Mr. Sigman was also a Managing Director of Newcastle’s external manager, an affiliate of Fortress Investment Group LLC. Mr. Sigman served as Vice President of Finance of Newcastle from 2006 to 2008 and as Assistant Controller from 2003 through 2006. From 1999 to 2003, Mr. Sigman was a Senior AuditorRossiello began his career at Ernst & Young LLP. He has servedLLP where he was a Senior Manager in the Banking and Capital Markets practice primarily focusing on providing client services to publicly traded companies within the banking and mortgage REIT industry as an executive officerwell as working with private companies within the mortgage origination and servicing industry. Mr. Rossiello holds a B.S. degree in Accounting from the State University of the Company since 2013 and as a director since 2018. In order to assist the Company in complying with New York Stock Exchange listing requirements relating to director independence, Mr. Sigman notified the Company that he would not stand for re-election asat Albany and is a director at the Annual Meeting. He will continue to serve as the Company’s Chief Financial Officer. Certified Public Accountant.

|

| | |

Raul E. MorenoJenny B. Neslin

General Counsel and Secretary Age: 39 | | Mr. MorenoMs. Neslin joined Angelo GordonGordon’s legal team as a Managing Director in November 2015 as Senior CounselApril 2021 and was appointed as our General Counsel and Secretary, oneffective April 2021.Since November 24, 2015. Mr. Moreno2021, Ms. Neslin also serves as the General Counsel and Secretary of our external manager, AG REIT Management, LLC.Twin Brook BDC, Inc., a non-listed business development company managed by an affiliate of Angelo Gordon. Prior to joining Angelo Gordon, Mr. Morenothe Company, Ms. Neslin was a Senior AssociateManaging Director and Deputy General Counsel at Kaye Scholer LLP from 2010 to 2015 where he focused onColony Capital, Inc. (NYSE:CLNY) (“Colony Capital”). At Colony Capital, Ms. Neslin was responsible for legal oversight of Colony Capital’s capital markets activities (including public and private equity M&A,and debt offerings), ongoing disclosure and reporting obligations under U.S. federal securities laws and corporate governance matters. In addition, from August 2015 to January 2018, Ms. Neslin served as General Counsel and Secretary for each of NorthStar Real Estate Income Trust, Inc. (“NS Income”) and NorthStar Real Estate Income II, Inc. (“NS Income II”). NS Income and NS Income II were public, non-traded real estate investment trusts managed by NorthStar Asset Management Group Inc. (“NorthStar”), until NorthStar’s merger with Colony Capital in January 2017. Prior to that, Mr. Morenojoining an affiliate of NorthStar in July 2013, Ms. Neslin was a private equityan associate at both Ropes & Gray LLP and Weil, Gotshal & Manges LLP. Before law school, Mr. Moreno worked as a technology investment banker in the Silicon Valley officeCapital Markets group at Clifford Chance US LLP, where she primarily advised REITs and investment banks in public and private capital markets transactions. Ms. Neslin holds a Bachelor of Morgan Stanley. Mr. Moreno graduated magna cum laudeMusic in Music Business from HarvardNew York University with an A.B. degree in economics and a Juris Doctor from StanfordBenjamin N. Cardozo School of Law School where he earned his J.D. Mr. Moreno has served as an executive officer of the Company since 2015.at Yeshiva University.

|

| | | |

Andrew Parks Chief Risk Officer Age: 4749 | | Mr. Parks joined Angelo Gordon in August 2009 as Chief Risk Officer and has served as our Chief Risk Officer since our IPO in July 2011. Before joining Angelo Gordon, Mr. Parks was associated with Morgan Stanley where he served as an Executive Director overseeing the risk management group for the ultra highultra-high net worth division in the U.S. and Latin America. Prior to joining Morgan Stanley, Mr. Parks worked as a corporate attorney at Cravath, Swaine & Moore LLP in New York in the areas of mergers and acquisitions, debt and equity capital markets, secured corporate credit and real estate acquisition/finance. Mr. Parks holds a B.A. degree from Tulane University and a J.D. degree from The University of Texas School of Law. He has served as an executive officer of the Company since 2011. |

Our executive officers are elected by the board of directors for an initial term which continues until the board meeting immediately following the next annual statutory meeting of stockholders, and thereafter are elected for a term ending at the following year’s board meeting and until their respective successors are elected and qualified. All of our executive officers are employed by Angelo Gordon, an affiliate of our Manager, in various executive, managerial and administrative positions.

CORPORATE GOVERNANCEDebra Hess

Board of Directors and Lead Independent Director (effective May 2, 2022)

Age: 57

Committees (prior to May 2, 2022):

- Audit (Chair)

- Compensation

Committees (effective May 2, 2022):

Our Manager manages our day-to-day operations, subject to the supervision of our board of directors. Our Manager, pursuant to a delegation agreement dated as of June 29, 2011, has delegated to Angelo Gordon the overall responsibility of our Manager’s day-to-day duties and obligations arising under our management agreement. Members of our board of directors are kept informed of our business through discussions with our Manager’s executive officers, by reviewing materials provided to them and by participating in meetings of the board of directors and its committees. A majority of the members of our board of directors are “independent,” as determined by the requirements of the NYSE and the regulations of the SEC. Our directors also keep informed about our business through supplemental reports and communications provided to them. Our independent directors meet in executive sessions without the presence of our corporate officers or non-independent directors.- Audit

- Compensation

Our board of directors has formed an audit committee, a compensation committee and a nominating and corporate governance committee and has adopted updated charters for each of these committees as of February 26, 2020. Each of these committees is composed exclusively of independent directors, as defined by the listing standards of the NYSE and, as it relates to the audit committee, Rule 10A-3(b)(1) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Moreover, the compensation committee is composed exclusively of individuals intended to be, to the extent provided by Rule 16b-3 of the Exchange Act, non-employee directors and will, at such times as we are subject to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), qualify as outside directors for purposes of Section 162(m) of the Code.

Board Leadership

Our business is conducted day-to-day by our officers and our Manager, under the direction of our chief executive officer and the oversight of our board of directors, to enhance long-term value for our stockholders. Our board of directors is elected by our stockholders to oversee our officers and our Manager and to assure that the long-term interests of the stockholders are being served.

The board of directors annually appoints a chairman of the board, who may or may not be our chief executive officer. If the individual appointed as chairman of the board is our chief executive officer, the board of directors will also appoint a lead independent director. David N. Roberts has served as chief executive officer of the Company since our initial public offering in 2011 and as chairman of the board since the 2012 annual meeting of stockholders. In these capacities, Mr. Roberts is involved in both our day-to-day operations and the strategic decision making at the board level.

We believe that it is in the best interests of our stockholders for Mr. Roberts to serve as both chairman of the board and chief executive officer because of his decisive, consistent and effective leadership. We also believe that having a lead independent director mitigates the risk of our chief executive officer also serving as our chairman, which, in certain circumstances, may cause management to have undue influence on a board of directors. Joseph LaManna serves as our lead independent director. Our lead independent director chairs executive sessions of the independent directors of the board and meetings of the full board of directors when the chairman is absent, and otherwise serves as a liaison between the independent directors, the full board of directors and management.

The board of directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The board of directors understands that there is no single, generally accepted approach to providing board leadership and the right board leadership structure may vary as circumstances warrant. Consistent with this understanding, our independent directors consider the board’s leadership structure on an annual basis.

Director Independence

Under the corporate governance standards of the NYSE, at least a majority of our directors, and all of the members of our audit, compensation and nominating and corporate governance committees, must be “independent,” as such term

is defined in the NYSE Listed Company Manual. The NYSE standards provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our board of directors has affirmatively determined that each of Debra Hess, Joseph LaManna and Peter Linneman satisfies the bright-line independence criteria of the NYSE and that none has a relationship with us that would interfere with such person’s ability to exercise independent judgment as a member of the board of directors. Therefore, we believe that all of these directors, who constitute a majority of our board of directors, are independent under the NYSE rules, including with respect to committee service.

The- Nominating and Corporate Governance Committee has adopted limits on the number(Chair)

| Ms. Hess served as Chief Financial Officer of publicNorthStar Asset Management Group Inc. (NYSE: NSAM) from July 2014 until January 2017, when NorthStar merged with Colony Capital. Ms. Hess had also served as Chief Financial Officer of NorthStar Realty Finance Corp. (NYSE: NRF) from July 2011 to January 2017, when NRF merged with Colony Capital. During her tenure at NorthStar until August 2015, Ms. Hess served as Chief Financial Officer of NorthStar’s non-traded companies. Ms. Hess also served as Interim Chief Financial Officer of NorthStar Realty Europe Corp. (NYSE: NRE) from June 2015 to November 2015. Prior to joining NorthStar, Ms. Hess served as Chief Financial Officer of H/2 Capital Partners, where she was employed from August 2008 to June 2011. From March 2003 to July 2008, Ms. Hess was a managing director at Fortress Investment Group, where she also served as Chief Financial Officer of Newcastle Investment Corp., a Fortress portfolio company boards on which our independent directors may serve,and a NYSE-listed alternative investment manager. From 1993 to enable them2003, Ms. Hess served in various positions at Goldman, Sachs & Co., including as Vice President in Goldman Sachs’ Principal Finance Group and as a Manager of Financial Reporting in Goldman Sachs’ Finance Division. Prior to have sufficient time to devote to their duties to the Company. Unless approved1993, Ms. Hess was employed by the board of directors, our independent directors may not serve on more than four (4) public company boards, which number includes service on our board of directors. TheChemical Banking Corporation in the corporate credit policy group and by Arthur Andersen & Company does not limit the number of not-for-profit boards on which our independent directors may serve. We have implemented procedures for interested parties, including stockholders, to communicate directly with our independent directors. We believe that providingas a method for interested parties to communicate directly with our independent directors, rather than the full board of directors, provides a more confidential, candid and efficient method of relaying any interested party’s concerns or comments. See “Communication with the Board of Directors and Independent Directors.”

Nomination of Directors

Before each annual meeting of stockholders, the nominating and corporate governance committee considers the nomination of all directors whose terms expire at the next annual meeting of stockholders and also considers new candidates whenever there is a vacancysupervisory senior auditor. Ms. Hess currently serves on the board of directors, or whenever a vacancy is anticipated due to a change in the size or compositionincluding as Chair of its audit committee, of Radian Group Inc. (NYSE: RDN), and on the board of directors of CenterPoint Properties Trust where she is the chair of the audit committee. Ms. Hess holds a retirementBachelor of Science in Accounting from the University of Connecticut and a Master of Business Administration in Finance from New York University. Ms. Hess has served as a director or for any other reasons. The nominatingof the Company since February 2018.

Due to her extensive mortgage banking, finance and corporate governance committee identifies director candidates based on recommendations from directors, stockholders,real estate experience, her role as the Chief Financial Officer of various publicly traded companies in our sector, and her significant financial, accounting and compliance experience at public companies, we believe Ms. Hess should serve as a member of our Board. | | | |

Dianne Hurley

Independent Director

Age: 59

Committees (prior to May 2, 2022): - Audit - Nominating and Corporate Governance

Committees (effective May 2, 2022): - Audit (Chair) - Nominating and Corporate Governance | | Ms. Hurley is currently the Chief Financial and Operations Officer of Moravian Academy. Previously, she was the Chief Administrative Officer of A&E Real Estate, one of the largest owner/operators of multi-family real estate in New York City. Since 2015, Ms. Hurley has also worked as an operational consultant to various startup asset management firms, including BayPine Capital, Stonecourt Capital and others. The committee may engageImperial Companies. From September 2009 to November 2011, Ms. Hurley served as the servicesfirst Chief Operating Officer of third-party search firms to assist in identifying or evaluating director candidates. In 2019, the nominating and corporate governance committee engaged the National Association of Corporate Directors to assist itGlobal Distribution in the searchAsset Management Division of Credit Suisse. From 2004 to September 2009, Ms. Hurley served as the founding Chief Administrative Officer of TPG-Axon, a newlarge investment management firm affiliated with TPG Capital. Ms. Hurley began her career in the real estate department of Goldman, Sachs & Co. Ms. Hurley currently serves as the Chair of the Audit Committee for American Healthcare REIT, Inc. (fka, Griffin-American Healthcare REIT IV). She has also previously served as an independent director candidate in light of Andrew L. Berger'san additional three public companies within the real estate industry. Ms. Hurley holds a Bachelor of Arts from Harvard University and Arthur Ainsberg's previously announced notification toa Master of Business Administration from Yale School of Management. Ms. Hurley has served as a director of the Company that they will not stand for re-election at the Company's 2020 Annual Meeting.since December 2020.

Our nominatingDue to her extensive financial and corporate governance committee charter provides that the nominating and corporate governance committee will consider nominations for board membership by stockholders. The rules that must be followed to submit nominations are contained in our bylaws and include the following: (i) the nomination must be received by the committee at least 120 days, but not more than 150 days, before the first anniversary of the mailing date for proxy materials applicable to the annual meeting prior to the annual meeting for which such nomination is proposed for submission and (ii) the nominating stockholder must submit certain information regarding the director nominee, including the nominee’s written consent.

The nominating and corporate governance committee evaluates annually the effectiveness of the board of directors as a whole and of each committee and conducts an annual assessment of each independent director. The nominating and corporate governance committee also identifies any areas in which the board of directors would be better served by adding new members with different skills, backgrounds or areas of experience. The board of directors considers director candidates, including those nominated by stockholders, based on a number of factors including: whether the board member will be “independent,” as such term is defined by the NYSE listing standards; whether the candidate possesses the highest personal and professional ethics, integrity and values; whether the candidate contributes to the overall diversity of the board of directors; and whether the candidate has an inquisitive and objective perspective, practical wisdom and mature judgment. Candidates are also evaluated on their understanding of our business,real estate experience, and willingness to devote adequate time to carrying out their duties, among other things. The nominating and corporate governance committee also monitors the mix of skills, experience and background of the members of the board of directors to assure that the board of directors has the necessary composition to effectively perform its oversight function.

While we do not have a formal policy about diversity, the board of directors is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which the board nominees are selected. Each individual is evaluated in the context of the board of directors as a whole, with the objective of recommending a group of directors that includes differences of viewpoint, professional experience, education, skill and other personal qualities and attributes and that can best perpetuate the success of the Company’s business and can represent shareholder interests through the exercise of sound judgment, using its diversity of experience.

Corporate Governance Guidelines

Our board of directors has also adopted corporate governance guidelines, which are available in the corporate governance section of the Company’s Web Site. These guidelines set forth the practices the board of directors follows with respect to, among other matters, the composition of the board of directors, director responsibilities, board committees, director access to officers, the Manager and independent advisors, director compensation and performance evaluation of the board of directors.

Retirement Policy

The board of directors believes that 75 is an appropriate retirement age for directors. Directors generally will not be nominated for re-election at any annual shareholders meeting following their 75th birthday. However, the Board may determine to waive this policy in individual cases.

Code of Business Conduct and Ethics

Our board of directors has established a code of business conduct and ethics that applies to our officers and directors as well as the employees, officers and directorsher experience as a director for several other public companies, we believe Ms. Hurley should serve as a member of our affiliates who provide us services (the “Code of Ethics”). Among other matters, our Code of Ethics is designed to deter wrongdoing and to promote:Board.

| | | | | | | | • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

Matthew Jozoff | | | | | • | accurate, complete, objective, relevant, timely and understandable disclosure in our SEC reports and other public communications;Independent Director Nominee

Age: 56

Committees (effective May 2, 2022): - Audit - Compensation | | Mr. Jozoff is currently a Managing Director at Radkl, a quantitative trading firm for digital assets and cryptocurrencies, where he has served since 2021. Prior to joining Radkl, Mr. Jozoff served in various positions at J.P. Morgan Chase & Co., including as a Managing Director and Co-Head of Fixed Income, Currencies, Commodities and Index Research (2019-2021); Head of Rates and Securitized Products Research (2013-2019); and Head of Mortgage/Securitized Products Research (2006-2013). Prior to joining J.P. Morgan, Mr. Jozoff worked at Goldman Sachs & Co. as a Vice President and Head of Mortgage Strategy from 1997 to 2006 and at Lehman Brothers in its Mortgage Research division from 1991 to 1997. Mr. Jozoff holds a Bachelor of Arts from Princeton University and a Master of Business Administration from the University of Pennsylvania.

Due to his extensive experience in the mortgage origination, fixed income and finance industries, we believe Mr. Jozoff should serve as a member of our Board. |

| | | | | • | compliance with applicable governmental laws, rules and regulations; |

| | | | | | • | prompt internal reporting of violations of the Code of Ethics to appropriate persons identified in the Code of Ethics; and |

| | | | | • | accountability for adherence to the Code of Ethics. |

Peter Linneman Any waiverIndependent Director

Age: 70 Committees: - Compensation (Chair) - Nominating and Corporate Governance

| | Dr. Linneman is currently the Emeritus Albert Sussman Professor of Real Estate, Finance, and Public Policy at the University of Pennsylvania, Wharton School of Business where he has been on the faculty since 1979. At Wharton, he was the Director of the Code of Ethics may be made only by our board of directors or one of our board committees. The Code of Ethics is posted inSamuel Zell and Robert Lurie Real Estate Center from 1986-1998 and the corporate governance sectionChairperson of the Company’s Web Site. We intend to satisfyWharton Real Estate Department from 1994-1997. Dr. Linneman is also the disclosure requirement regarding any amendment to, orfounding principal of Linneman Associates, a waiverreal estate advisory firm, and the CEO of a provision of the Code of Ethics by posting such informationAmerican Land Funds and KL Realty Fund, both private real estate acquisition firms. He currently serves on the Company’s Web Site.Board’s Role in Risk Oversight

The board of directors is responsible for overseeing our risk management policies and practices. Our executive officers, who are responsible for our day-to-day risk management practices, regularly present to the board of directors on our overall risk profileof Regency Centers Corporation (NYSE: REG), Paramount Group, Inc. (NYSE: PGRE) and the processes byEquity Commonwealth (NYSE: EQC), each of which such risks are mitigated. Our Manager also regularly reports to the board on various matters related to our risk exposure. Through regular and consistent communication, our Manager provides reasonable assurances to our board of directors that all of our material operational and investment risks, including among others, liquidity risk, interest rate risk and capital market risk, are being addressed.

Board Meetings and Annual Meeting of Stockholders

The board of directors held ten meetings (including regularly scheduled and special meetings) in 2019, and each director that was a director in 2019 attended at least 75% of the board meetings and each such director also attended at least 75% of his or her committee meetings. We have a policy that directors attend each annual meeting of stockholders; however, some or all of our directors may be unable to attend the Annual Meeting due to scheduling conflicts or other obligations that may arise. All of our directors in 2019 attended the 2019 annual meeting. The independent directors meet in executive session at least once per quarter during a regularly scheduled board meeting without management. As lead independent director, Mr. LaManna presides at the executive sessions of the independent directors.

Committee Membership

The current committees of the board of directors are the audit committee, the compensation committee and the nominating and corporate governance committee. The table below provides current membership information.

| | | | | | | | Director | | Audit

| | Compensation | | Nominating and

Corporate

Governance

| Arthur Ainsberg | | | | | | | Debra Hess | | | | | | | Joseph LaManna | | | | | | | Peter Linneman | | - | | | | |

- Member - ChairmanBoard Committees

Below is a descriptionpublic real estate investment trust. Dr. Linneman has served on over 20 public and private company boards, including as director of each committeeeleven New York Stock Exchange listed companies. Dr. Linneman holds both a masters and a doctorate degree in economics from the University of the board of directors. The board of directors has affirmatively determined that each committee consists entirely of independent directors pursuant to rules established by the NYSE and rules promulgated under the Exchange Act.

Audit Committee

Our audit committee consists of Messrs. Ainsberg and LaManna and Ms. Hess, each of whom is an independent director and “financially literate” under the rules of the NYSE. Ms. Hess chairs our audit committee and serves as our audit committee financial expert, as that term is defined by the SEC. Our audit committee assists the board of directors in overseeing:

our accounting and financial reporting processes;

the integrity and audits of our consolidated financial statements;

our compliance with legal and regulatory requirements;

the qualifications and independence of our independent auditors; and

the performance of our independent and internal auditors.

Our audit committee is responsible for engaging independent registered public accounting firms, reviewing with the independent registered public accountants the plans and results of the audit engagement, approving professional services provided by the independent registered public accountants, reviewing the independence of the independent registered public accountants, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls.

The audit committee held four meetings in 2019.

Compensation Committee

Our compensation committee consists of Messrs. LaManna, Ainsberg, Linneman and Ms. Hess, each of whom is an independent director under the rules of the NYSE. Mr. Linneman chairs our compensation committee. The responsibilities of our compensation committee include evaluating the performance of our executive officers, reviewing the compensation payable, if any, of our executive officers, evaluating the performance of our Manager, reviewing the equity compensation and fees payable to our Manager under the management agreement, administering our equity incentive plans and any other compensation plans, policies and programs, discharging the board of director’s responsibilities relating to compensation payable to our independent directors and reviewing and recommending to the board of directors compensation plans, policies and programs. No executive officer of the Company is involved in determining non-executive director compensation levels.

The compensation committee held four meetings in 2019.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. LaManna and Linneman and Ms. Hess, each of whom is an independent director under the rules of the NYSE. Mr. LaManna chairs our nominating and corporate governance committee. Our nominating and corporate governance committee is responsible for seeking, considering and recommending to our board of directors qualified candidates for election as directors and recommending a slate of nominees for election as directors at each annual meeting of stockholders. The committee also recommends to our board of directors the appointment of each of our executive officers. It also periodically prepares and submits to our board of directors for adoption the committee’s selection criteria for director nominees. It reviews and makes recommendations on matters involving the general operation of our board of directors and our corporate governance and annually recommends to our board of directors the nominees for each committee of the board of directors. In addition, the committee annually conducts an evaluation of our board of directors performance.

The nominating and corporate governance committee held four meetings in 2019.

Other Committees

Our board of directors may from time to time establish other committees to facilitate the management of the Company.

Stock Ownership Guidelines